Hey, lads’n’lasses! What a year 2022 was! Happenings in the world, crypto, and NFTs kept us busy all year. It was also an important year for Piggylet since all the major development on our platform and operations happened during 2022. As Piggylet Team, we started to work on the buidl phase of the market (There are no bears here, just buidls and bulls in our dictionary).

We are pretty happy with what we have accomplished so far and excited to release Piggylet platform on the Testnet and hear your thoughts soon.

We took some notes from the 2022 market reports and like to share them with you. You can see all references at the end of the article to make your own research.

Before deep divin’ some subjects, let’s take a look at what happened in both Crypto and NFT on a shortlist.

So, if you check all the happenings with a bird’s eye view, it is time to divin’!

Quality Over Everything

In the second half of 2022, the crypto and NFT market experienced a significant downturn as investors moved away from risk assets. Many altcoins dropped by more than 95%, 951 cryptocurrencies completely died, and NFT projects without fundamental value saw their value go to zero. However, projects with strong fundamentals managed to hold their ground.

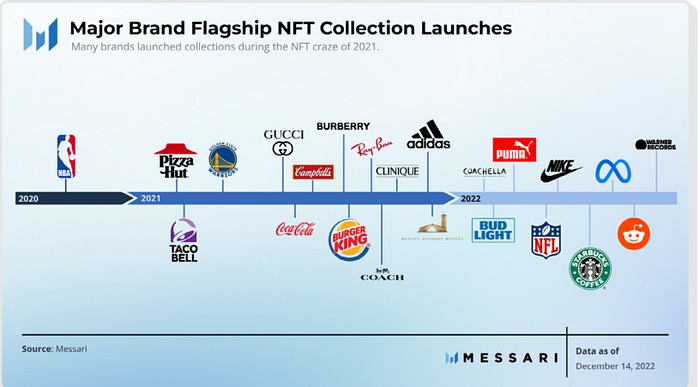

Despite the market downturn, progress in the DeFi and ZK ecosystems continued. Additionally, institutional adoption of crypto increased, with major brands such as Disney, Starbucks, Adidas, Tiffany & Co, and Nike quietly embracing blockchain and web3 technology. Large banks also showed increasing interest in the sector, with Fidelity launching a crypto service for investors and BlackRock partnering with Coinbase to provide institutional clients with access to crypto.

Developers continued to experiment with on-chain applications. The usage of the Alchemy platform increased by three times since the beginning of the year, and monthly verified smart contracts were up 2.6 times year-over-year in September 2022.

The long-awaited transition of Ethereum from proof-of-work (POW) to proof-of-stake (POS) also occurred. This reduced the energy consumption of the Ethereum blockchain by 99.9% and made the currency deflationary.

The market and community learned a valuable lesson from these events, that fundamental value and sustainability are crucial. As a result, it is not surprising that crypto investors are now more likely to invest in higher-quality names such as Bitcoin and Ethereum, as sustainable tokenomics, mature ecosystems, and liquidity are more important than ever.

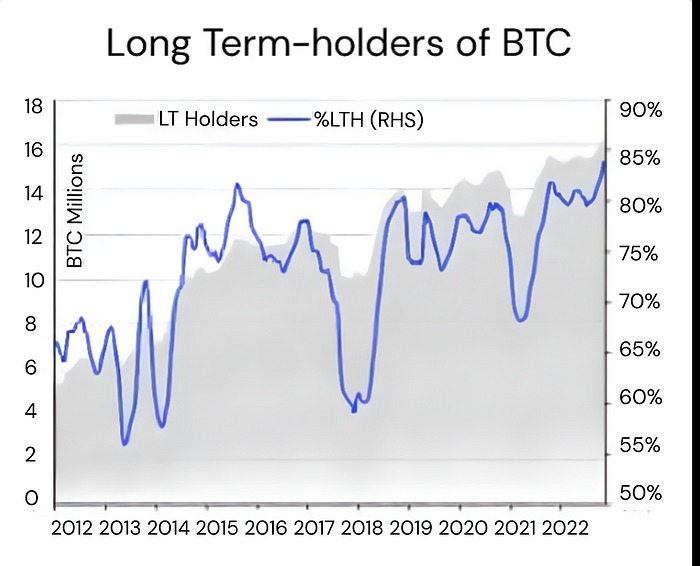

Graph by Coinbase

We see an increase Long Term Holders of BTC, which shows people start to prioritize quality and sustainability over other factors in the current market.

On the NFT side, projects that continue to build and create value for their communities will be the ones that stand the test of time.

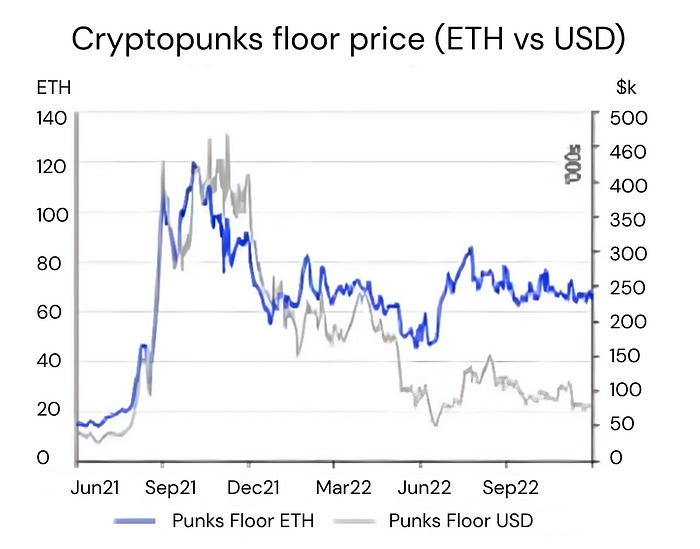

Graph by Coinbase

NFT projects with strong community and fundamentals always withstanding. Cryptopunk floor price is a good metric to see this.

DeFi is Getting Stronger

The recent collapse of FTX and Alameda has reminded investors of the importance of holding their own keys, similar to the MT. Gox incident in 2014. This has led to billions of dollars in losses for investors, as FTX was one of the top centralized exchanges. This resulted in the increased popularity of decentralized exchanges since trust in centralized exchanges has weakened.

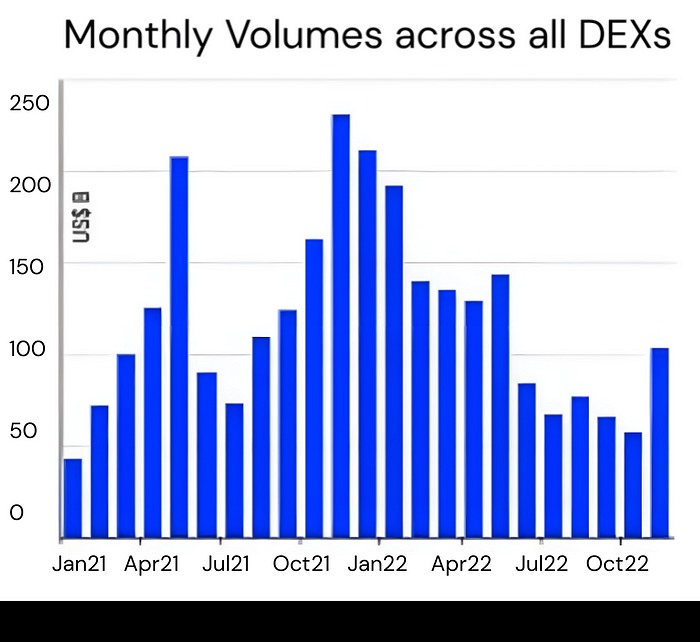

Graph by Coinbase

Monthly volume across all DEXs increased considerably during the collapse of FTX Exchange. The trend has the potential to keep growings because of the fundamentals behind decentralization.

The current macroeconomic issues around the world have added to market fears, but the DeFi lending protocols, such as Compound and Aave, remained fully operational. Institutions like Celsius and 3AC repaid their DeFi loans before others in order to withdraw their deposited collateral. Following the FTX collapse, DeFi transaction volume spiked, with an increase of 68%.

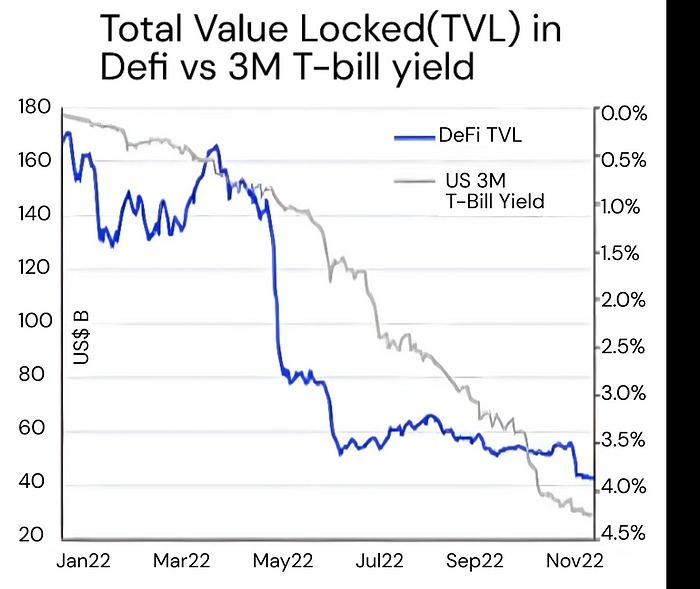

Graph by Coinbase

Even though DeFi TVL dropped since the beginning of the year, it still holds on the $40–50B bracket. Due to recent events, we may see it getting stronger and breaking the current bracket.

As regulators start to become more involved in the sector and interest in DeFi continues to grow, we may see the emergence of permissioned DeFi dapps. This type of DeFi would combine institutional-grade compliance standards with code-enforced transparency, and could have compelling use cases for settlement and cross-border payments, as well as innovations in the tokenization of real-world assets. Positive regulatory developments, improvements in smart contracts, and new practices could potentially bring about another DeFi Summer.

Real-World Asset Tokenization

The concept of tokenizing real-world assets is exciting and has the potential to unlock significant liquidity and utility. For some institutions, tokenization is a less risky way of having crypto exposure compared to investing directly in tokens. Banks are already utilizing tokenized versions of financial instruments across several institutional DeFi use cases, often via public blockchains. This trend is expected to increase in 2023.

Stablecoins, such as USDC and DAI, is also a form of real-world asset tokenization. Both have been top-tier stablecoins and have seen almost no volatility throughout the bear market.

On-chain communities have demonstrated a demand for real-world assets. In mid-2022, MakerDAO invested $500M worth of DAI into US Treasuries and corporate bonds. Goldfinch, a company that provides loans collateralized off-chain, currently has an active loan value of around $100M. Jia allows business owners to take out blockchain-based loans and generates substantial yields for liquidity providers backed by real-world businesses and assets. 2023 may bring interesting new applications for real-world assets, such as flash loans and real estate.

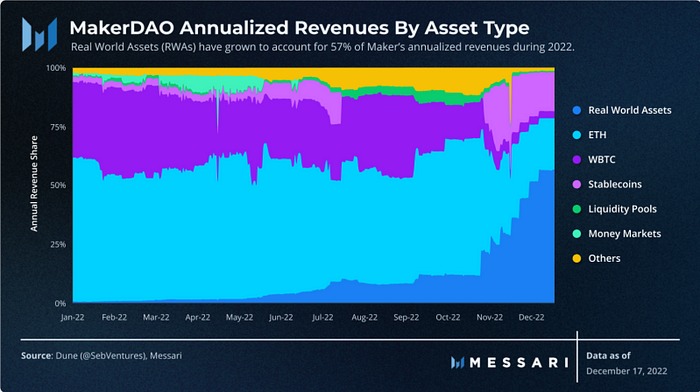

Graph by Messari, Dune(@Sebventures)

MakerDAO already utilizes Real World Assets. While the adaptation of Web3 increases, the growth of RWAs may increase tremendously.

NFT Marketplaces

NFT sales are affected heavily like any other risk asset in financial markets. High volumes in late 2021 and early 2022 lowered dramatically with all the happenings. If we understand the fundamentals of NFT technology and ongoing adaptations, we can say that it is a healthy correction and normal movement in such bad market conditions. The NFT market has the potential to grow trillion dollars high, and the current market shows how early we are.

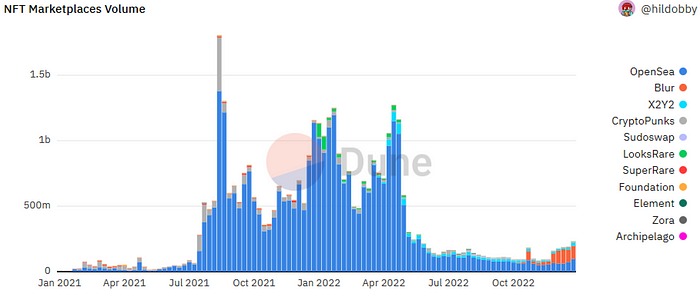

Graph by Dune(@hlldobby)

From $1.8B weekly volume candles, NFT marketplaces volume dropped below $100M in the current correction phase. Also, we can see the sale volume of new platforms Blur and X2Y2 start to rival the most popular NFT Marketplace Opensea.

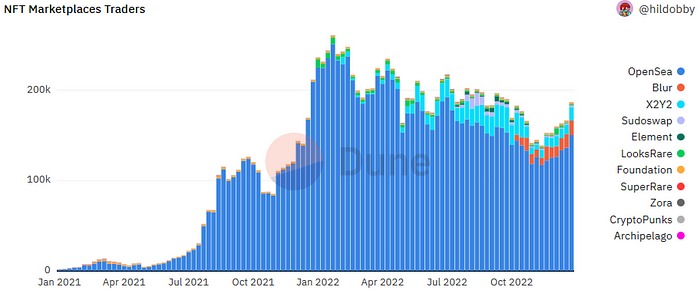

Graph by Dune(@hlldobby)

Even though some people panic selling their NFTs there are buyers. Around 200,000 traders still actively trading weekly on NFT marketplaces and try to get an advantage from price movements.

NFT-Backed Lending

If you do not know already, NFT-Backed Lending is always our favorite topic. You can read its potential from our past medium article: NFT-Backed Lending and NFT Marketplaces: Statistics, Potentials, and The Future | by Piggylet | Dec, 2022 | Medium

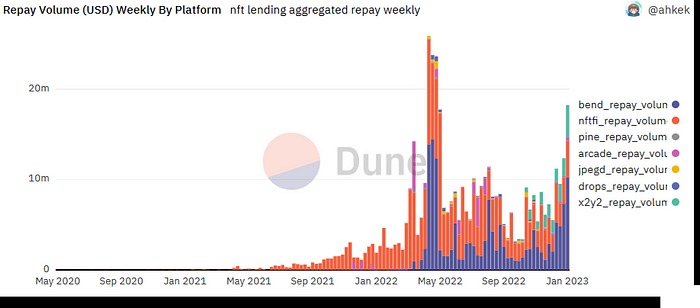

Like every market, NFT-Backed Lending volumes dropped during the happenings. It recovers at a rapid pace when we compare it with other markets.

In the short term: Current solutions do not cover the majority of the NFT market. Still, the numbers are impressive. With Piggylet’s solutions, NFT-Backed Lending has the potential to grow even with today’s market standards.

In the long term: Real-world non-fungible assets are not widely used yet. As adaptation accelerates, we will see people use NFT-Backed Lending platforms to finance real-world assets.

For both terms, NFT-Backed Lending is not even started. We are excited to offer Piggylet’s solutions to the market and help it to grow.

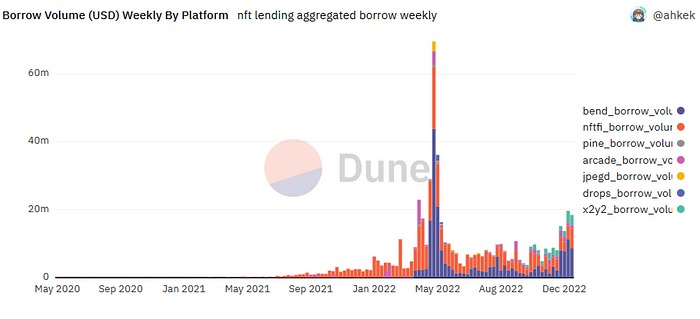

Graph by Messari, Dune(@ahkek)

Graph by Messari, Dune(@ahkek)

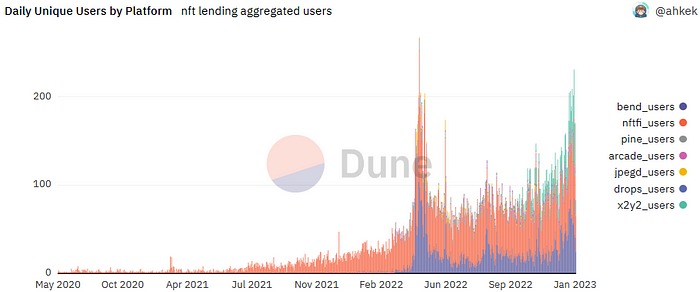

NFT-Backed Lending platforms recover their volumes at a rapid pace than NFT marketplaces. NFT collectors and investors realize the solution and start to benefit from it. Piggylet’s solutions aim to address more people in the market.

Graph by Messari, Dune(@ahkek)

Due to low market coverage, NFT-Backed Lending platforms only have 4800+ Unique Users. Only Around 140+ people use these platforms daily. The numbers will grow tremendously when market coverage increases and real-world adaptation happens.

NFT Gaming

New Meanings of NFTs

The NFT market is still in its early stages, but the technology behind NFTs has the potential to revolutionize how ownership and identity function in the digital economy. With the world increasingly shifting towards a digital realm, NFTs will play a critical role in the infrastructure that allows for frictionless ownership and identity. There is potential that NFTs as a data construct will eventually wrap around tens of trillions of dollars worth of assets.

Despite the recent downturn in the NFT market, adoption is still growing, with new uses from companies for NFTs emerging. For example:

-Starbucks announced in September 2022 that its popular loyalty program is powered by NFTs.

-Adidas is pairing NFTs with physical merchandise

-The New York Knicks are offering NFT holders access to exclusive events and tickets to home games

-Reddit has avatar NFTs which they refer to as “digital collectibles,” which have amassed over 4 million unique holders and over US$11M in secondary sales since launching in July 2022

-Tiffany & Co. collaborated with CryptoPunks to create 250 digital passes that were minted and redeemed by CryptoPunk holders in exchange for punk-themed jewelry

Beyond these use cases, corporations are also beginning to utilize NFT technology to provide digital verification of physical goods.

Graph by Messari

The Web3 adaptation of famous brands already happening, and it may potentially accelerate in 2023 and beyond.

We also observe traditional gaming industry interest increase in the web3. EA CEO Andrew Wilson recently called web3 “the future of our industry”. Ubisoft CEO Yves Guillemot stated that blockchain gaming is a “revolution” in the industry and plans to develop blockchain games. Microsoft, whose Activision acquisition is now in jeopardy due to an FTC lawsuit, has also been investing in web3 startups as part of their exploration of the space. Industry-wide, gaming companies have been hiring blockchain, NFT, and crypto experts as they search for the next evolution in gaming.

As web3 technology continues to advance, NFTs will become an integral part of everyday operations and transactions, with companies and customers using and exchanging data and digital assets seamlessly. However, the technology behind these transactions will likely become invisible to the average person, who will never need to stop and think about the web3 and NFTs that are helping ensure authenticity, security, and intellectual property rights.

Web3 is Here for Long Term

Web3 represents the next step in the evolution of the internet, similar to the transformation from an agricultural to an industrial society. With blockchain technology at its core, Web3 will fundamentally change the way we interact with one another and engage. According to a survey of institutional investors, it is believed that the crypto market is here to stay, despite short-term price fluctuations and the actions of some negative actors.

References:

NFT Market Overview 📊 (dune.com)

NFT Lending Aggregated Dash 📊 (bendDao, NFTfi, PINE, Arcade, JPEGD, Drops, x2y2) (dune.com)

2023 Crypto Market Outlook (coinbase.com)

Crypto Theses for 2023 (messari.io)

2023 Predictions — by Paul Veradittakit — VeradiVerdict

10 predictions for crypto in 2023 (cointelegraph.com)

11 Crypto Predictions for 2023 | VanEck

What’s next for cryptocurrency and digital assets: PwC

2022 NFT Recap: The Year of Rollercoaster Rides (chainwitcher.com)

Thanks for being here to read about the next era of NFT-backed financial instruments. Follow us on Twitter and Medium. You may also subscribe with your email on Piggylet.com to never miss news and updates on our products and projects. Always hodl and buidl, see you soon lads’n’lasses!

Website: https://piggylet.com

Twitter: https://twitter.com/piggyletdefi