Piggylet is a community-based peer-to-peer lending platform to bring the DeFi experience to the NFTs. Users can use their NFTs as collateral to borrow, and other users lend a loan for their collateral NFT. As a result, lenders enjoy a high Annual Percentage Rate (APR) while borrowers generate liquidity without selling their NFTs. Users can also use ‘Vaults’ to generate instant liquidity with their collateral NFTs, and stakers who contribute the liquidity earn Annual Percentage Yield (APY).

While enjoying the DeFi experience, Piggylet users can increase their advantages on Piggylet with the native NFT collection, Piggylads NFT! Proud hodlers of Piggylads can use Piggylet.com like regular users while benefiting from extra utilities.

Piggylet’s goal is to be more than a lending platform but a community that helps each other to hodl their precious assets. We are all lads’n’lasses of our community which is the primary purpose to hodl and buidl!

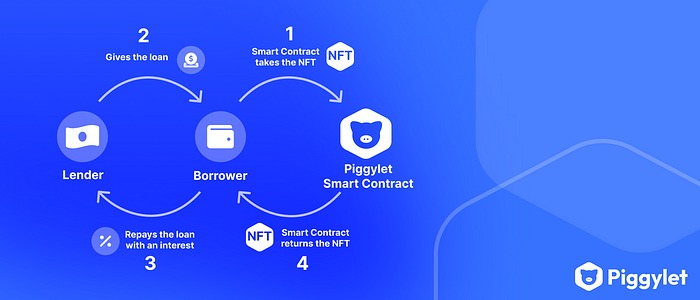

Peer-to-Peer Lending and Borrowing

Peer-to-peer lending and borrowing is the core system of Piggylet. There are two peers in this mechanism, borrowers and lenders.

Borrowers who want to generate liquidity from their NFT asset without selling it may use the Piggylet platform to seek a loan.

- They can choose an NFT of their own to create a loan request.

- Borrowers may determine all the details; loan amount, APR, list duration, payback duration, and liquidation threshold.

- They may choose to specify only, list duration and payback duration to only accept offers from lenders.

- After everything is set, they collateralize their NFT and match a lender to give them the loan.

- Borrowers enjoy liquidity without selling their NFTs.

- If Borrowers do not pay the loan with promised APR on the payback time, or the collection floor price daily TWAP (Time Weighted Average Price) drops below the specified liquidation threshold, they lose their NFT ownership.

For more info about the liquidation, please visit: https://piggylet.gitbook.io/product-docs/p2p-lending-borrowing/about-liquidation.

Lenders who want to gain interest by lending borrowers who use NFTs as collaterals may use Piggylet platform.

- Lenders may check ‘Loan Requests’ to see a list of collateral NFTs.

- When they spot a good deal, lenders may give the loan instantly or offer borrowers a loan amount and APR.

- After they give the loan, lenders wait until the payback time to earn their APR from repayment.

- If borrowers fail to repay, collateralized NFT defaults. Lenders may claim the NFT if they specified not to liquidate before giving the loan liquidators may claim the NFT and pay the lender.

For more info about the liquidation, please visit: https://piggylet.gitbook.io/product-docs/p2p-lending-borrowing/about-liquidation.

The Vault

Piggylet Vault Diagram

Vault is an instant loan option for borrowers and a stake option to earn APY for lenders. The peer-to-peer lending and borrowing process includes waiting to find a match between peers. Instead, peers may seek instant liquidity and interest, so Vault is the perfect solution.

There are two peer groups for the Vault, stakers, and borrowers.

Stakers are liquidity providers of the Vault. They stake their cryptocurrencies to earn APY, which is pre-determined by the Vault.

- Stakers stake their cryptocurrency and contribute to liquidity

- When borrowers take instant liquidity from the Vault, stakers earn APY on borrowers’ repayment.

- If borrowers do not repay, the collateralized NFT is liquidated, and liquidators may claim the NFT.

Borrowers are APY providers of the Vault. They enjoy instant loans from the vaults by collateralizing their NFTs

- Borrowers collateralize NFT, which the Vault accepts, and take an instant loan.

- The loan amount is set to 30% of the collateral NFT’s value.

- The Vault APY is pre-determined. Borrowers should be aware to complete repayment according to that rate on the payback time.

Liquidation System and Liquidators

If borrowers do not pay the required amount to close the deal, their collateral NFTs default. In this case, borrowers’ NFT ownerships have ceased. The collateral NFT’s new owner becomes the lender.

In some cases, Lenders may not want to liquidate collateral NFTs and may choose to take the loan and their earned interest. Liquidators may close the contract by liquidating the NFTs and paying lenders’ loan and earned interest.

Fragments Market

Fragments Market is a fractional investment solution to own a portion of an NFT.

The details will be revealed in the next Medium posts.

Piggylads, A Utility Enabler NFT Collection

Piggylads is an NFT collection that brings new opportunities to use Piggylet.

Piggylads are the representation of our community and web3 identity. Because whom do you borrow from or whom do you lend? A friend? Close but no. From a lad, a Piggylad!

Piggylads utilities and much more information about; why we are releasing an NFT collection and our vision will be detailed in the next Medium posts. So be in touch!

Thanks for being here to read about the next era of NFT-backed financial instruments. Follow us on Twitter and Medium. You may also subscribe with your email on Piggylet.com to never miss news and updates on our products and projects. Always hodl and buidl, see you soon lads’n’lasses!

Website: https://piggylet.com

Twitter: https://twitter.com/piggyletdefi